Introduction to AI in Algorithmic Trading

Defining AI in Algorithmic Trading

The financial sector has witnessed a seismic shift with the integration of artificial intelligence into algorithmic trading systems. These cutting-edge tools harness computational power to analyze market trends at unprecedented scales. Modern trading algorithms now incorporate machine learning techniques that evolve continuously, adapting to new market conditions in real-time. What sets these systems apart is their ability to process both quantitative data and qualitative information, including news sentiment and social media trends, to form comprehensive market assessments.

Unlike traditional models that follow static rules, contemporary trading platforms demonstrate remarkable adaptability. They can adjust strategies mid-execution when market volatility exceeds predetermined thresholds. This dynamic approach has proven particularly valuable during periods of economic uncertainty, where conventional models might struggle to respond effectively. The true innovation lies in how these systems complement human expertise rather than replace it, creating synergistic relationships between quantitative analysts and their algorithmic counterparts.

AI-Powered Strategies for Enhanced Trading

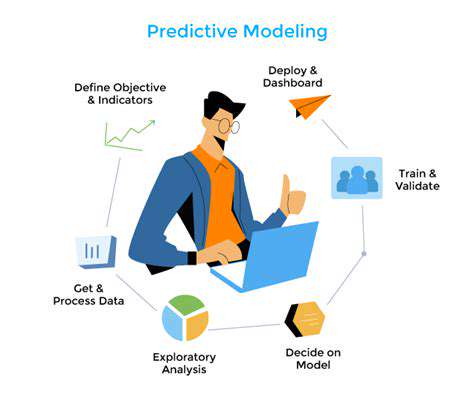

Contemporary trading floors employ diverse machine learning techniques that go beyond simple pattern recognition. Reinforcement learning systems, for instance, continuously refine their strategies through simulated trading environments before deployment. These virtual proving grounds allow algorithms to experience thousands of market scenarios, preparing them for real-world volatility without financial risk.

Sentiment analysis tools represent another breakthrough, parsing financial news and earnings calls at speeds impossible for human analysts. These systems can detect subtle linguistic cues that often precede market movements, providing traders with early warning signals. Similarly, anomaly detection algorithms monitor order flow patterns, identifying potential market manipulations or emerging trends before they become apparent through conventional analysis.

Risk Management in AI-Driven Algorithmic Trading

The implementation of AI in trading requires sophisticated safeguards against systemic risks. Modern platforms incorporate multiple layers of validation, including Monte Carlo simulations that test strategies against extreme but plausible market conditions. This stress-testing approach helps identify potential failure points before they can affect live trading operations.

Regulatory technology (RegTech) solutions now integrate with trading algorithms to ensure compliance in real-time. These systems automatically adjust trading parameters when approaching regulatory limits or when market conditions suggest increased risk exposure. Perhaps most importantly, human oversight remains the final safeguard, with experienced traders monitoring algorithmic performance and retaining override capabilities during periods of exceptional volatility.

The Future of AI-Driven Risk Management in Algorithmic Trading

AI's Enhanced Predictive Capabilities

Next-generation risk management systems are developing anticipatory capabilities that go beyond traditional statistical models. By incorporating alternative data sources like satellite imagery and supply chain information, these platforms can identify macroeconomic trends before they manifest in conventional market data. This predictive edge allows firms to position themselves advantageously before major market movements occur.

Improved Accuracy and Speed in Decision-Making

Latency continues to decrease as edge computing brings processing power closer to exchange servers. This technological evolution enables near-instantaneous reaction to market-moving events, with some systems executing trades within microseconds of news releases. The combination of speed and precision creates competitive advantages that were unimaginable a decade ago.

Personalized Risk Profiles

Portfolio management systems now generate customized risk assessments for individual investors based on their specific financial circumstances and risk tolerance. These tailored solutions consider factors ranging from investment horizons to correlated asset exposures, creating truly personalized wealth management strategies.

Automated Risk Monitoring and Reporting

Regulatory reporting has been transformed by AI systems that automatically compile required disclosures while maintaining comprehensive audit trails. These platforms can detect reporting anomalies or compliance gaps in real-time, significantly reducing regulatory risk. The automation of these processes has dramatically reduced operational costs while improving accuracy.

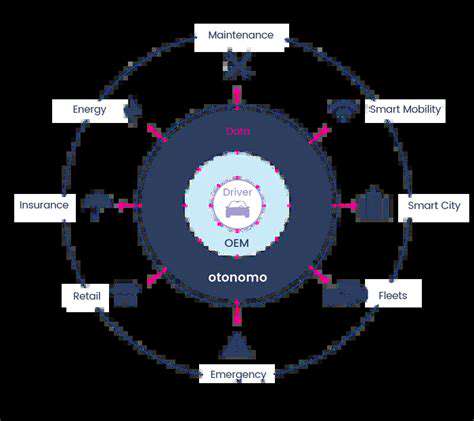

Integration with Existing Systems

Modern AI solutions emphasize interoperability, designed to work seamlessly with legacy trading infrastructure. Application programming interfaces (APIs) allow for gradual implementation, enabling firms to modernize their systems incrementally without disruptive overhauls.

Challenges and Ethical Considerations

The financial industry continues to grapple with questions surrounding algorithmic accountability and transparency. Developing explainable AI models remains a critical challenge, particularly as regulatory scrutiny intensifies. Firms must balance the competitive advantages of proprietary algorithms with the need for sufficient transparency to maintain market integrity and regulatory compliance.