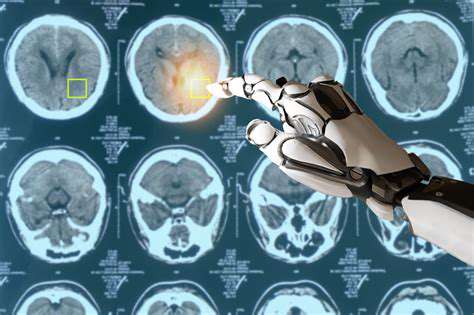

AI-Powered Transaction Monitoring

AI technology is transforming transaction monitoring, allowing financial organizations to analyze enormous volumes of transaction data instantly. This enables rapid detection of suspicious patterns and irregularities, including unusual transaction sizes, geographic anomalies, or atypical customer actions. These advanced systems identify and flag potential fraud far more quickly and accurately than traditional rule-based approaches, decreasing money laundering risks and other financial crimes.

Through continuous learning and adaptation to new patterns, AI-driven systems can proactively spot emerging threats and modify detection parameters as needed. This flexibility proves essential in the constantly evolving financial crime landscape where criminals continually develop new methods to bypass controls.

Enhanced Due Diligence Procedures

AI dramatically improves due diligence processes by automating and simplifying customer identity verification and business activity assessment. The technology analyzes extensive public data sources including news reports, social media content, and corporate records to detect potential risks and warning signs. AI can also spot inconsistencies in provided information, highlighting suspicious activities that might otherwise remain undetected.

Automated due diligence accelerates the process while reducing human error, enhancing accuracy and consistency across the board. This creates a stronger, more dependable compliance structure that protects institutions from financial crime while optimizing operations.

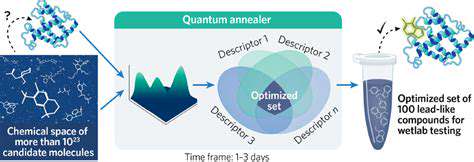

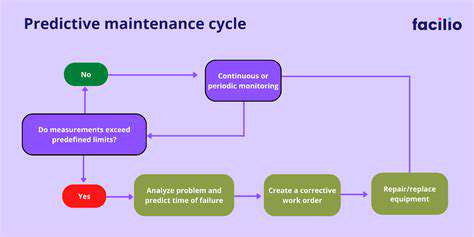

Predictive Modeling for Risk Assessment

AI algorithms examine historical data to identify patterns that predict future risks. This predictive capacity lets financial institutions anticipate potential money laundering or terrorist financing activities before they occur, enabling preventative measures. By recognizing high-risk clients or transactions, institutions can allocate resources strategically and concentrate on areas needing most attention.

This proactive approach minimizes financial and reputational harm from financial crime while helping institutions optimize compliance resources for greater efficiency and cost-effectiveness.

Improved KYC/AML Reporting

AI-driven solutions automate creation of comprehensive KYC/AML reports, ensuring reporting accuracy and consistency. These reports provide complete customer risk profiles and transaction overviews, helping compliance officers quickly identify and resolve potential issues. Automation frees up valuable time, allowing staff to focus on more complex strategic tasks.

Automated Sanctions Screening

AI-powered systems automatically check transactions against international sanctions lists and watchlists, ensuring regulatory compliance. This real-time screening minimizes risks of accidentally processing transactions involving sanctioned parties. This critical function protects financial institutions from sanctions violations and related penalties.

AI-driven screening speed and accuracy reduce risks of financial penalties and reputational damage from non-compliance while ensuring adherence to international legal requirements.

Integration with Existing Systems

Successful AI integration into AML compliance requires seamless connection with current systems. This ensures new AI tools interact smoothly with other software and databases, preventing data silos and enabling comprehensive views of customer and transaction information. Effective integration is vital for successful implementation and optimal use of AI solutions.

Enhanced Data Security and Privacy

Implementing strong security measures is essential when incorporating AI into AML systems. This includes protecting sensitive customer information and ensuring compliance with data privacy regulations like GDPR. AI models must be secured against manipulation or intrusion to maintain data integrity and system reliability.

Establishing rigorous security protocols around AI models and data is crucial for preserving customer and stakeholder trust. This involves regular security assessments and adherence to industry best practices.