Investment Strategies Powered by AI

Artificial intelligence is rapidly transforming the investment landscape, offering investors unprecedented opportunities to optimize their portfolios and potentially achieve superior returns. AI-powered algorithms can analyze vast datasets of market trends, economic indicators, and company financials to identify patterns and predict future market movements with greater accuracy than traditional methods. This capability allows for more nuanced and data-driven investment strategies, potentially mitigating risks and enhancing long-term performance.

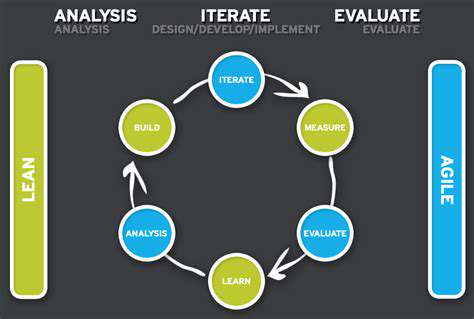

These sophisticated algorithms can adapt to evolving market conditions in real-time, making dynamic adjustments to investment portfolios. This adaptability is crucial in a constantly shifting market environment, where traditional strategies often struggle to keep pace.

Personalized Investment Portfolios

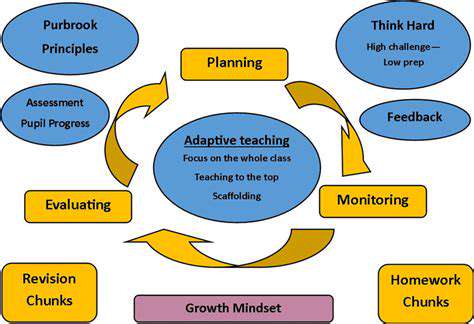

AI algorithms can tailor investment strategies to individual investor profiles, considering factors such as risk tolerance, financial goals, and time horizon. This personalized approach allows for the creation of investment portfolios that are uniquely aligned with each investor's specific needs and preferences. This personalized approach will lead to a greater degree of investor satisfaction and potentially higher returns aligned with individual financial goals.

By understanding individual investor behavior and preferences, AI can suggest adjustments that improve the overall portfolio performance without sacrificing the investor's risk tolerance or financial goals.

Enhanced Due Diligence and Research

AI tools can streamline the research and due diligence process for potential investments. AI can process vast amounts of data, including financial reports, news articles, and social media sentiment, to provide comprehensive insights into companies and markets. This accelerates the investment decision-making process and empowers investors with more in-depth knowledge about the companies they are considering investing in.

Such tools can identify emerging trends and opportunities in the market, providing a competitive edge over traditional investment methods. This enhanced due diligence capability is essential in navigating the complexities of the modern financial world.

Automated Trading and Execution

AI-powered trading platforms can automate the buying and selling of securities, executing trades at optimal times and prices, potentially reducing transaction costs and improving overall returns. This automation is particularly beneficial for high-frequency trading, where speed and precision are critical.

These platforms can also adapt to rapidly changing market conditions, ensuring that trades are executed in a timely and efficient manner. This level of automation significantly reduces the human error factor, leading to more consistent and predictable outcomes.

Increased Transparency and Accountability

The use of AI in investment strategies can lead to increased transparency and accountability in the investment process. Detailed records of the data used and the algorithms applied provide insights into the decision-making process, which can be critical for investor confidence and trust. This enhanced transparency will be crucial in developing a more robust and trustworthy investment ecosystem.

Furthermore, the use of AI can help mitigate biases and improve decision-making based on objective data, rather than subjective opinions. This objectivity is essential for ensuring fair and equitable investment practices.

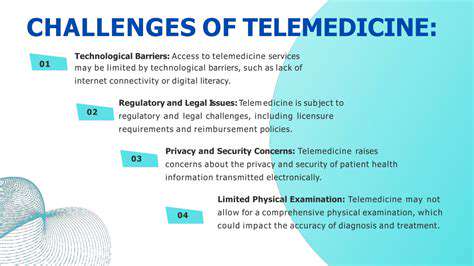

Challenges and Considerations

While AI presents exciting opportunities for the future of investment, it also introduces challenges that need to be carefully considered. Issues such as algorithmic bias, data security, and the potential for unintended consequences need to be addressed. Robust regulatory frameworks and ethical guidelines are crucial to ensure that AI is used responsibly and ethically in the investment arena.

Ensuring the accuracy and reliability of the data used by AI algorithms is paramount to avoid misleading investment decisions. The development and implementation of AI in investment strategies should prioritize transparency and maintain human oversight to prevent potential abuses or systemic risks.