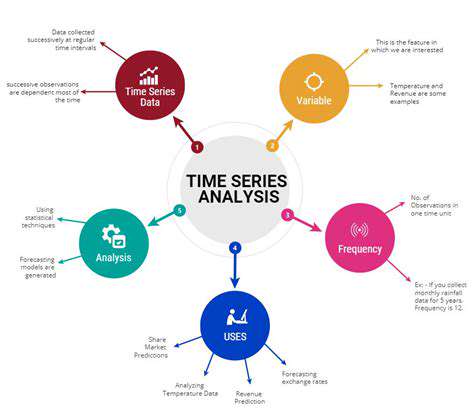

Key Concepts in Time Series Analysis

Understanding Time Series Data

Time-ordered data creates unique analytical opportunities and challenges. The sequence itself contains information - stock prices form patterns, economic indicators follow leading/lagging relationships, and sensor data shows system dynamics. Temporal context transforms independent data points into a connected story.

Effective analysis begins with domain understanding. Are weekends excluded from this sales data? Does daylight saving time affect these measurements? Such contextual knowledge ensures proper interpretation of observed patterns and prevents analytical missteps.

Stationarity and its Importance

Stationary series maintain consistent statistical properties - constant mean, variance, and autocorrelation - across time segments. Many models require this stability for reliable predictions. Economic shocks or regime changes often violate stationarity assumptions, requiring transformations.

Differencing - subtracting consecutive values - frequently converts non-stationary data into stationary form. Other approaches include logarithmic transformations or structural break adjustments. The Phillips-Perron and KPSS tests complement the Dickey-Fuller approach for robust stationarity assessment.

Trend Analysis

Trend extraction separates persistent movements from short-term fluctuations. A linear trend might suffice for steady growth, while piecewise regression can capture changing growth rates. The Hodrick-Prescott filter offers another approach, separating cyclical from trend components.

Misidentified trends distort all subsequent analysis. An apparent upward trend might actually reflect structural breaks or level shifts. Multivariate approaches can help distinguish true trends from confounding factors.

Seasonality and Cyclical Components

Seasonal decomposition (e.g., STL) quantifies regular intra-year patterns, while Fourier analysis identifies underlying periodicities. Proper seasonal adjustment reveals underlying trends - crucial for month-to-month retail performance comparisons.

Cycles lack fixed periods, requiring different detection methods. Spectral analysis identifies dominant frequencies, while wavelets localize cyclical patterns in time. Business cycle analysis often combines multiple indicators to identify expansion and contraction phases.

Model Selection and Evaluation

The model zoo includes ARIMA, GARCH for volatility, VAR for multivariate systems, and newer machine learning hybrids. Selection depends on data characteristics and forecast horizon. Short-term predictions might use simple models, while long-range forecasts benefit from incorporating external variables.

Backtesting against historical data validates model robustness. Walk-forward validation tests how models would have performed in real-time forecasting, exposing overfitting. Information criteria (AIC/BIC) balance fit quality against model complexity.

Applying Time Series Models in Financial Forecasting

Understanding Time Series Data in Finance

Financial markets generate complex time series reflecting countless transactions and decisions. Prices incorporate expectations, creating challenging forecasting problems. Returns typically show volatility clustering - calm and turbulent periods - while volumes may exhibit different seasonal patterns than prices.

The efficient market hypothesis suggests prices reflect available information, making pure time series prediction difficult. However, anomalies like momentum and mean-reversion effects create opportunities. Successful models often combine time series techniques with cross-asset relationships and macroeconomic factors.

Applying Various Time Series Models

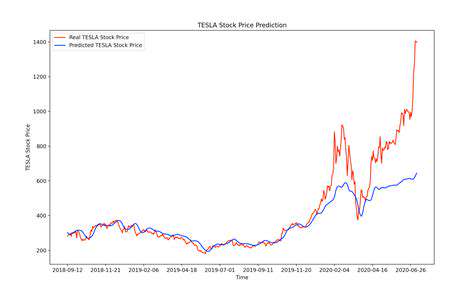

Simple models provide benchmarks. Random walks often outperform complex models for liquid assets, demonstrating forecasting difficulties. Moving averages underpin many technical trading strategies, while exponential smoothing adapts flexibly to recent changes.

GARCH models excel in volatility forecasting, crucial for risk management. For multivariate problems, vector autoregression (VAR) captures inter-asset dynamics. The most sophisticated approaches combine these statistical methods with machine learning for enhanced pattern recognition.

Regardless of methodology, robust financial forecasting requires continuous model monitoring. Structural breaks occur during crises, and changing market regimes demand model adjustments. The best practitioners blend quantitative models with qualitative judgment about market conditions.