AI-Powered Loan Application Processing

The financial sector is witnessing a seismic shift as artificial intelligence redefines loan processing workflows. Where traditional methods relied on labor-intensive reviews, modern systems now leverage sophisticated algorithms to process application data with unprecedented speed, cutting approval times from weeks to mere hours in some cases. This technological leap enables loan officers to dedicate their expertise to nuanced cases while maintaining high throughput.

Machine learning models excel at detecting subtle patterns across thousands of data points - anomalies that might escape even the most experienced human analyst. By identifying these risk indicators early, institutions can make more informed lending decisions, potentially reducing default rates by significant margins. The precision of these systems continues to improve as they process more applications, creating a virtuous cycle of enhanced accuracy.

Enhanced Customer Experience

Today's borrowers expect seamless digital interactions, and AI delivers by transforming clunky application processes into smooth, intuitive experiences. Real-time status updates and 24/7 access to application portals eliminate the uncertainty that plagued traditional loan processes. The anxiety of waiting weeks for a response has given way to transparent, immediate feedback.

Advanced systems now go beyond processing to offer personalized financial guidance. By analyzing an applicant's complete financial picture, these tools can suggest optimal loan products and terms, creating value-added interactions that build lasting client relationships. This consultative approach represents a fundamental shift from transactional lending to relationship-based financial services.

Improved Risk Assessment

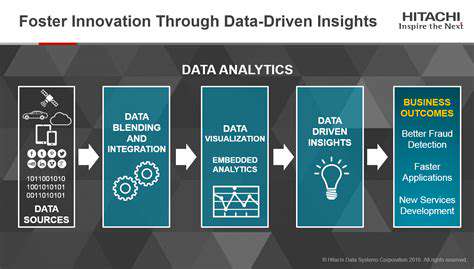

Modern risk evaluation extends far beyond basic credit scores. AI systems synthesize information from diverse sources - bank statements, payment histories, employment verification, and even spending patterns - to construct multidimensional risk profiles. This comprehensive analysis helps lenders identify both promising opportunities and potential red flags that might otherwise go unnoticed.

The predictive power of these systems continues to grow as they identify subtle correlations. An algorithm might detect, for instance, that applicants with certain employment histories and spending behaviors represent exceptionally low risks despite moderate credit scores. These insights allow for more nuanced lending decisions that balance risk and opportunity.

Automation of Manual Tasks

Routine processing tasks that once consumed countless work hours now happen instantaneously through AI automation. Document verification that took days now occurs in seconds, while data entry errors - a persistent challenge in manual processing - have become increasingly rare. This operational efficiency translates directly to bottom-line results, with some institutions reporting processing cost reductions of 40% or more.

As systems handle the repetitive work, human staff can focus on complex cases requiring judgment and creativity. Loan officers now spend more time consulting with clients and less time pushing paperwork - a shift that improves both employee satisfaction and customer experiences.

Data Security and Privacy

With great data power comes great responsibility. Financial institutions must implement military-grade encryption and rigorous access controls to protect sensitive client information. Regular security audits and continuous monitoring have become non-negotiable components of any AI lending system. The trust between lender and borrower depends on absolute confidence in data protection measures.

Regulatory Compliance

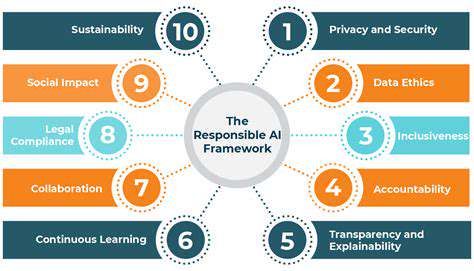

The regulatory landscape struggles to keep pace with AI advancements, creating compliance challenges for early adopters. Forward-thinking institutions establish dedicated teams to monitor regulatory changes and ensure all automated processes meet current standards. Transparency in algorithmic decision-making has emerged as a critical requirement, with explainable AI becoming an industry priority.

Ethical Considerations

As algorithms influence more lending decisions, the financial industry faces tough questions about fairness and accessibility. Historical data can perpetuate existing biases if not carefully scrubbed and balanced. Leading institutions now employ multidisciplinary ethics teams to audit algorithms and ensure they promote equitable access to credit. Continuous monitoring and adjustment remain essential as societal norms and financial landscapes evolve.