Automated Investment Strategies and Portfolio Management

Automated Investment Strategies: A Comprehensive Overview

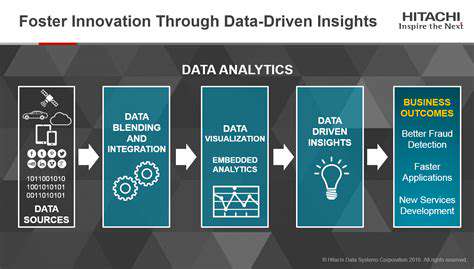

Automated investment strategies are rapidly gaining popularity as investors seek ways to streamline their portfolio management and potentially enhance returns. These systems leverage algorithms and pre-programmed rules to execute trades and adjust holdings, often with minimal human intervention. This approach can help free up investors' time and potentially reduce emotional decision-making biases that can negatively impact investment performance.

The core principle behind automated investment strategies is to follow a predefined set of rules. These rules, based on various factors like market trends, historical data, and risk tolerance, are designed to guide the investment process, often aiming for consistent results over time.

Types of Automated Investment Strategies

A wide range of automated investment strategies exist, catering to different investment goals and risk appetites. These strategies can be categorized based on their underlying investment principles and the types of assets they manage. Examples include index fund replications, actively managed portfolios with automated adjustments, and strategies focused on specific market sectors or asset classes.

Robo-advisors are a popular type of automated investment platform. These platforms use algorithms to create and manage investment portfolios based on user-provided information about their financial goals and risk tolerance.

Benefits of Using Automated Investment Strategies

Automated investment strategies can offer several advantages over traditional methods. These include increased efficiency and reduced emotional biases, as well as the ability to follow a consistent investment plan over time. The potential for better long-term outcomes, by minimizing impulsive decisions, is a key benefit.

Furthermore, automated strategies can be particularly beneficial for investors with limited time or expertise in managing their portfolios, allowing them to achieve diversified investment portfolios.

Challenges and Considerations

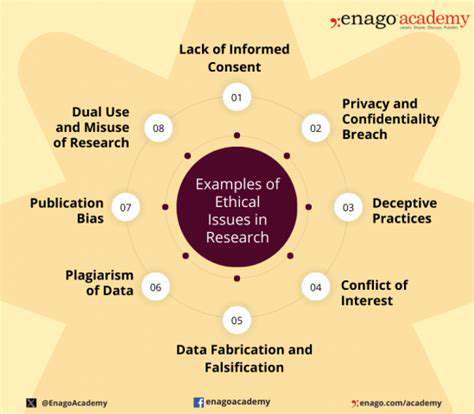

While automated investment strategies present significant advantages, potential challenges and considerations exist. One such consideration is the potential for unforeseen market shifts or unexpected events that might not be adequately accounted for in the pre-programmed rules.

Another key consideration is the selection of a trustworthy and reliable platform or provider for automated investment services, as well as the need for ongoing monitoring and adjustments to the strategy as market conditions evolve.

Risk Management in Automated Strategies

Effective risk management is crucial when employing automated investment strategies. This involves carefully defining risk tolerance levels and incorporating appropriate diversification strategies into the investment plan. Implementing stop-loss orders or other risk mitigation techniques can help protect investments during periods of market volatility.

Regular portfolio reviews and adjustments to the automated strategy can help ensure that the investment aligns with the investor's evolving financial goals and risk profile.

Future Trends and Innovations

The field of automated investment strategies is constantly evolving with advancements in technology and market insights. Machine learning algorithms are increasingly being incorporated into these strategies to enhance predictive capabilities and adapt to changing market dynamics. This allows for more sophisticated portfolio optimization and potentially higher returns.

Expect to see further integration with other financial tools and platforms, such as tax optimization services and financial planning software, as automated investment strategies become more mainstream.