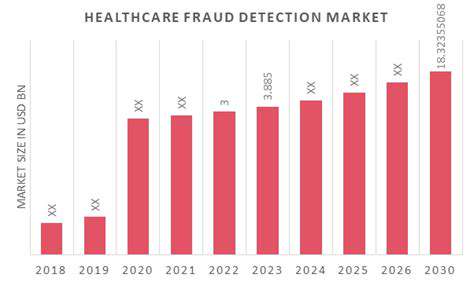

The Growing Threat of Healthcare Fraud

The Escalating Cost of Care

Healthcare expenses continue to climb at an alarming rate, creating financial hurdles for patients and policymakers alike. Soaring drug prices and bureaucratic inefficiencies are inflating medical bills exponentially, pushing essential services out of reach for many while depleting public health funds. This unsustainable trajectory frequently compromises care standards as providers implement austerity measures that may negatively affect treatment results.

Multiple interconnected elements - from cutting-edge medical technologies to shifting population demographics and insurance models - fuel this concerning pattern. Only by thoroughly examining these components can we formulate viable solutions to maintain both service quality and affordability.

The Burden on Insurance Providers

Health insurers grapple with unprecedented challenges as medical costs spiral upward. Exploding claim volumes coupled with pricier treatment protocols are stretching their financial capacity to the limit, inevitably triggering premium hikes and benefit reductions for subscribers. This creates a self-perpetuating cycle where diminished coverage options further restrict healthcare accessibility.

Impact on Patient Affordability

Skyrocketing medical expenses have made basic healthcare unattainable for growing segments of the population. Countless households now face impossible choices between essential medications, preventive screenings, and emergency interventions versus other basic necessities. When financial constraints force treatment delays or avoidance, health conditions deteriorate unnecessarily while socioeconomic health gaps continue widening.

The ripple effects extend far beyond individual cases, manifesting in poorer community health metrics and heightened financial insecurity across demographic groups.

The Role of Technology in Healthcare

While digital innovations revolutionize medical diagnostics and treatment modalities, their economic implications present a double-edged sword. Cutting-edge equipment and systems demand substantial capital investments along with ongoing maintenance and training expenditures that contribute to overall cost inflation.

Implementing rigorous cost-effectiveness evaluations before adopting new technologies remains critical to ensure they genuinely enhance care delivery without inadvertently creating additional financial barriers.

Addressing the Future of Healthcare

Combating healthcare's affordability crisis demands comprehensive, coordinated solutions. Pioneering approaches must simultaneously rein in expenditures while guaranteeing universal access to competent medical services. Successful strategies will incorporate preventive medicine initiatives, streamlined administrative processes, and transparent pricing structures.

All stakeholders - from legislators to practitioners to patients - share responsibility for cultivating a more viable healthcare ecosystem. Only through sustained cooperation and honest dialogue can we develop realistic frameworks that meet the system's evolving requirements while protecting vulnerable populations.

Advanced Computational Methods for Fraud Identification

Supervised Learning Approaches

Classification algorithms including logistic regression, support vector machines, and decision trees form the backbone of modern fraud detection systems. These models extract predictive patterns from annotated datasets where each entry carries verified legitimacy markers. For instance, logistic regression calculates fraud probability scores based on input variables, while SVMs establish optimal decision boundaries between authentic and suspicious transactions. Their effectiveness stems from directly modeling relationships between observable data characteristics and fraud indicators.

Unsupervised Pattern Recognition

When labeled training data remains scarce, clustering techniques like k-means and anomaly detection methods prove invaluable for spotting irregular transaction patterns. These approaches automatically group similar financial activities, isolating statistical outliers that may represent fraudulent cases. By analyzing variables such as payment amounts, geographic locations, and temporal patterns, these systems can surface novel fraud schemes that haven't been previously documented.

Neural Network Applications

Deep learning architectures excel at processing complex, high-dimensional financial data where traditional methods struggle. Specialized network types address different fraud detection challenges - convolutional networks parse visual transaction evidence while recurrent networks track sequential spending behaviors. Their multilayer processing enables identification of subtle, non-linear fraud indicators that simpler models might overlook, significantly improving detection precision.

Model Combination Strategies

Integrating multiple algorithms through ensemble techniques often yields superior fraud detection performance. Methods like random forests generate numerous decision trees and aggregate their predictions to enhance accuracy while minimizing overfitting. Boosting algorithms like AdaBoost iteratively refine their models by focusing on previously misclassified cases. These hybrid approaches typically deliver more comprehensive and reliable fraud screening than individual models.

Temporal Pattern Analysis

Healthcare fraud frequently reveals itself through abnormal time-based patterns. Specialized analytical techniques including ARIMA modeling and exponential smoothing can identify suspicious temporal deviations in claims data. Unexpected surges in specific procedure billing or regional claim volumes often signal fraudulent activities that warrant investigation.

Adaptive Learning Systems

Reinforcement learning frameworks enable continuous improvement of fraud detection mechanisms. These systems refine their decision policies based on performance feedback, allowing them to adapt to emerging fraud tactics. This dynamic capability proves particularly valuable in the ever-evolving landscape of financial deception.

Performance Optimization

Selecting optimal fraud detection models requires careful analysis of multiple evaluation metrics including precision-recall balance and ROC curve characteristics. The decision process must account for dataset specifics like dimensionality, completeness, and distribution patterns. Comprehensive testing protocols help ensure chosen models maximize fraud identification while minimizing false positive rates.