The Future of XAI in Finance: Overcoming Challenges

Understanding the Need for XAI in Finance

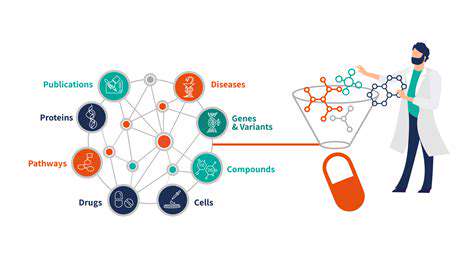

Explainable AI (XAI) is rapidly gaining traction in the financial sector, driven by the increasing complexity of financial models and the growing need for transparency and trust. Traditional financial models, often opaque black boxes, can be difficult to interpret, leading to concerns about fairness, bias, and accountability. XAI addresses these concerns by providing insights into how these models arrive at their decisions, allowing stakeholders to understand the reasoning behind financial predictions and recommendations.

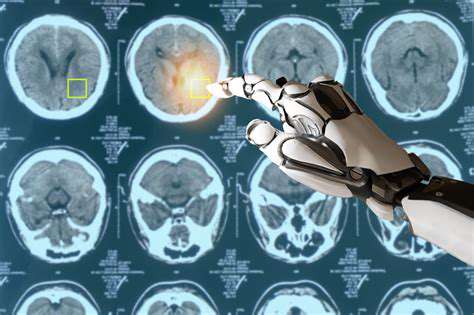

Addressing Bias and Fairness in Financial Algorithms

One of the critical applications of XAI in finance is mitigating bias in lending, investment, and risk assessment algorithms. These algorithms, trained on historical data, can inadvertently perpetuate existing societal biases. XAI methods can identify these biases by examining the features influencing model decisions, facilitating the development of fairer and more equitable algorithms that lead to more inclusive financial outcomes for all stakeholders.

By understanding the factors contributing to biased outcomes, financial institutions can proactively address these issues and build more trustworthy systems, ultimately fostering greater social responsibility within the financial sector. This is crucial for building public trust and ensuring that financial decisions are not unfairly impacting specific demographics.

Improving Model Interpretability and Trust

XAI techniques, such as feature importance analysis and rule-based explanations, enhance the interpretability of complex financial models. This interpretability fosters trust among stakeholders, including regulators, investors, and customers. When financial decisions can be explained, it becomes easier to identify and correct errors, ensuring the reliability and robustness of financial systems.

Enhancing Regulatory Compliance and Auditability

The financial industry is heavily regulated, and XAI plays a crucial role in meeting these regulatory requirements. Explainable models are more easily audited, allowing regulators to verify the fairness and accuracy of financial decisions. This enhances transparency and accountability, reducing the risk of financial misconduct and ensuring that models adhere to established guidelines and regulations.

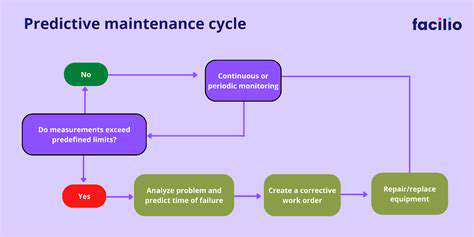

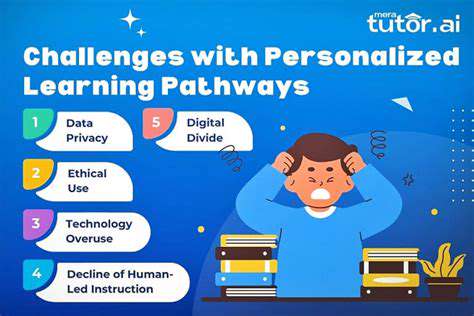

Overcoming the Challenges of Implementing XAI in Finance

Despite the numerous benefits, implementing XAI in the finance sector faces several challenges. These include the computational cost of some XAI methods, the need for skilled personnel to develop and interpret XAI models, and the potential for XAI explanations to be oversimplified, potentially masking underlying complexities. Addressing these challenges requires ongoing research and development, along with investment in training and education for financial professionals.

The Future of XAI in Financial Innovation

The future of XAI in finance is bright, promising innovative applications in areas like personalized financial advice, fraud detection, and algorithmic trading. As XAI technology continues to mature and become more accessible, financial institutions can leverage its capabilities to develop more sophisticated and effective models. This will lead to increased efficiency, improved risk management, and ultimately, greater financial well-being for individuals and businesses alike. The continuous evolution of XAI will be crucial for staying ahead of emerging financial challenges and opportunities in the digital age.