Understanding the Root Causes

Fraud is rarely an isolated event; it's often a symptom of deeper systemic issues within an organization. A purely transactional analysis approach, focusing solely on the immediate action, often misses the underlying motivations and pressures that drive fraudulent behavior. This holistic approach goes beyond the specifics of a transaction to examine the organizational culture, processes, and controls that might be creating vulnerabilities. Identifying these root causes, whether they stem from inadequate oversight, poorly defined roles, or a lack of clear communication channels, is crucial for implementing effective preventative measures.

Examining the pressures on individuals within the organization is also paramount. Financial difficulties, job insecurity, or a desire for personal gain, among other factors, can create a fertile ground for fraudulent activity. Acknowledging these potential motivators enables proactive measures to address them before they escalate into fraudulent behavior. Understanding the human element is vital to a comprehensive fraud prevention strategy.

Strengthening Internal Controls and Processes

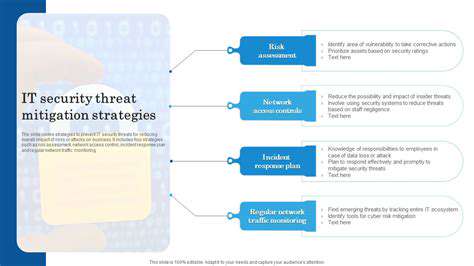

Robust internal controls, encompassing everything from segregation of duties to regular audits and reconciliation procedures, are fundamental to fraud prevention. These controls should be meticulously designed and implemented, and their effectiveness must be consistently monitored. A detailed review of existing processes is essential to identify any potential weaknesses that could be exploited by fraudsters. This includes examining all stages of a transaction, from initial authorization to final reporting. Improving and tightening these controls can significantly reduce the opportunities for fraudulent activities.

Beyond technical controls, fostering a culture of accountability and transparency is equally important. Employees should be encouraged to report suspicious activities without fear of reprisal. Clear communication channels and established reporting procedures should be in place to facilitate the prompt identification and escalation of potential fraud issues. This proactive approach cultivates a strong deterrent against fraudulent behavior.

Enhancing Communication and Collaboration

Effective communication between different departments and teams is crucial for a holistic approach to fraud prevention. Information sharing and collaboration can help detect patterns and anomalies that might otherwise go unnoticed. Implementing systems for seamless data exchange and consistent reporting across different departments significantly strengthens the ability to identify suspicious activities.

Collaboration with external partners, such as legal and accounting firms, can also provide valuable insights and expertise. Sharing information and best practices with industry peers can reveal emerging trends and highlight potential vulnerabilities. Leveraging external resources strengthens the overall fraud prevention strategy and fosters a proactive approach to the dynamic nature of fraud.

Implementing a Culture of Integrity and Ethics

A strong ethical culture within an organization is a powerful deterrent against fraud. Promoting a sense of shared responsibility and accountability for ethical conduct is essential. This involves clear communication of ethical guidelines, regular training on fraud awareness, and consistent reinforcement of ethical standards throughout the organization. By prioritizing integrity and ethical behavior at all levels, organizations cultivate an environment where fraud is less likely to flourish.

Implementing ethical decision-making frameworks and providing resources for employees to address ethical dilemmas are also important components of this culture. Creating an environment where employees feel comfortable raising concerns and knowing they will be taken seriously is crucial. This fosters a sense of trust and encourages responsible conduct.

Modern intelligent transport systems (ITS) rely heavily on real-time data collection from various sources, including sensors embedded in roads, traffic cameras, GPS data from vehicles, and even social media feeds. This data, encompassing speed, volume, location, and incident reports, forms the foundation for effective traffic management. Integrating these disparate data streams into a unified platform is a crucial step towards achieving comprehensive understanding of the current traffic situation and predicting future trends. Effective integration requires robust data processing and standardization techniques to ensure accuracy and reliability of the information shared between different systems.

The Future of Fraud Protection: AI and Beyond

Machine Learning's Role in Fraud Detection

Machine learning algorithms are revolutionizing fraud detection by analyzing vast datasets of transactions and user behaviors to identify patterns indicative of fraudulent activity. These algorithms can learn from historical data to identify anomalies and predict future fraudulent attempts with increasing accuracy. This allows for proactive fraud prevention, significantly reducing financial losses and improving the overall security of online platforms and financial institutions. The ability to continuously learn and adapt makes machine learning a powerful tool in the ongoing battle against evolving fraud tactics.

Beyond Machine Learning: The Rise of AI

Artificial intelligence (AI) extends beyond machine learning, encompassing more sophisticated techniques like deep learning and natural language processing. AI can analyze unstructured data, such as text messages and social media posts, to uncover subtle indicators of fraud that might be missed by traditional methods. Deep learning models, for example, can identify complex relationships and patterns in data that are difficult for humans to discern, leading to even more accurate and proactive fraud detection capabilities. This capability is crucial in the constantly evolving landscape of fraud techniques.

The Importance of Data Security and Privacy

Effective fraud protection relies heavily on the secure management and utilization of data. Protecting sensitive customer information from breaches is paramount. Robust security measures, including encryption, access controls, and regular security audits, are essential to prevent unauthorized access and data manipulation. Maintaining compliance with data privacy regulations, such as GDPR and CCPA, is also critical. Balancing the need for data analysis with the need for protecting customer privacy is a significant challenge, requiring a strong ethical framework.

Real-Time Fraud Detection: The Need for Speed

In the digital age, speed is of the essence in fraud detection. Fraudulent activities often unfold rapidly, and timely intervention is crucial to minimizing losses. Implementing real-time fraud detection systems is therefore vital. These systems analyze transactions in real-time, allowing for immediate identification and blocking of suspicious activity. This proactive approach enables financial institutions and e-commerce platforms to respond swiftly to potential threats, mitigating the financial impact and protecting customer accounts from undue harm.

The Human Element: The Role of Fraud Analysts

While AI and machine learning are transforming fraud detection, human expertise remains invaluable. Fraud analysts play a critical role in interpreting the results generated by algorithms, investigating complex cases, and adapting strategies to emerging fraud techniques. Their judgment and experience are essential for identifying subtle anomalies and patterns that might be missed by automated systems. Fraud analysts act as a crucial safeguard, ensuring that AI tools are used effectively and ethically.

Future Trends and Challenges: Staying Ahead of the Curve

The future of fraud protection will likely involve a combination of advanced AI techniques, sophisticated data analysis, and continuous adaptation to evolving fraud methods. The need for proactive fraud prevention and real-time detection will only intensify. Challenges include the ethical implications of AI-driven decision-making, the growing sophistication of fraudsters, and the need to balance security with user experience. Continuous innovation and collaboration between technology providers and financial institutions are crucial for staying ahead of the curve and mitigating fraud risks.