Improving Accuracy and Efficiency

Intelligent automation significantly enhances the accuracy of financial reporting by automating data entry, validation, and reconciliation processes. Manual errors are minimized, leading to a more reliable and trustworthy financial picture. This increased accuracy translates directly to improved decision-making throughout the organization, allowing for proactive adjustments and strategic planning based on precise data.

Furthermore, the streamlined processes facilitated by intelligent automation contribute to increased efficiency. By automating repetitive tasks, employees can focus on higher-level strategic initiatives, leading to a more productive workforce and reduced operational costs. The time saved from automating mundane tasks allows for a more agile response to changing market conditions and evolving reporting needs.

Automating Data Collection and Consolidation

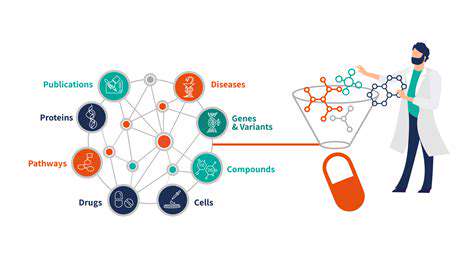

Intelligent automation tools excel at collecting data from various sources, including disparate databases, spreadsheets, and legacy systems. This capability significantly reduces the time and effort required for manual data gathering and consolidation. Data is pulled, cleansed, and formatted automatically, ensuring consistency and eliminating the potential for errors associated with manual data manipulation.

This automated data collection and consolidation process is crucial for maintaining data integrity and consistency throughout the entire financial reporting cycle. The standardized approach ensures that everyone is working with the same accurate data, facilitating a more collaborative and efficient workflow.

Enhancing Data Validation and Reconciliation

Automated validation rules and reconciliation procedures are integral to intelligent automation in financial reporting. These tools scrutinize data for inconsistencies and errors, identifying discrepancies early in the process and preventing them from impacting the final reports. This proactive approach to error detection saves significant time and resources compared to traditional methods that often uncover errors only at the final stages.

The enhanced validation and reconciliation capabilities also help to identify potential fraud or irregularities early on. By continuously monitoring data for anomalies, intelligent automation acts as a crucial safeguard, ensuring the integrity and reliability of the financial reporting process.

Optimizing Reporting Processes

Intelligent automation streamlines the entire reporting process, from data extraction to report generation and distribution. By automating the generation of various reports, including financial statements, dashboards, and customized analyses, intelligent automation reduces manual effort and minimizes the risk of human error. This automation enables faster reporting cycles, allowing stakeholders to access critical information more quickly and make timely decisions.

Improving Compliance and Governance

Intelligent automation plays a vital role in ensuring compliance with regulatory requirements and maintaining strong corporate governance. Automated systems can be programmed with predefined rules and regulations, ensuring that reports adhere to all relevant standards and guidelines. This automated adherence to regulatory requirements reduces the risk of non-compliance penalties and maintains the organization's credibility and reputation.

Furthermore, the audit trail generated by automated systems provides clear visibility into the processes involved in creating and validating financial reports. This transparency supports internal audit efforts and enhances overall governance.

Boosting Collaboration and Communication

Intelligent automation facilitates better collaboration and communication among various stakeholders involved in the financial reporting cycle. Automated workflows and dashboards provide real-time access to data and reports, enabling efficient communication across departments and teams. This increased transparency and accessibility contribute to more informed decision-making and faster problem-solving.

The streamlined communication channels fostered by intelligent automation also enhance the efficiency of interactions with external stakeholders, such as investors and regulators. This improved communication strengthens relationships and builds trust in the organization's financial reporting practices.

Scalability and Future-Proofing

Intelligent automation solutions are designed for scalability, enabling organizations to adapt to growing data volumes and changing reporting needs. As businesses evolve, these systems can be easily adjusted and expanded to accommodate new requirements without significant disruption to existing workflows. This adaptability ensures that the financial reporting process remains efficient and effective as the organization grows.

By automating processes and creating a more flexible, future-proof system, intelligent automation allows organizations to adapt to future changes in regulations, technologies, and market conditions with greater ease and efficiency.

Automating Data Extraction and Validation: Precision and Speed

Data Extraction Strategies

Automating data extraction involves employing various strategies, ranging from simple text parsing to complex machine learning models. Choosing the right strategy hinges on the nature of the data source and the desired output. For structured data, like CSV files or databases, dedicated libraries and APIs can streamline the process. Unstructured data, such as web pages or documents, often requires more sophisticated techniques, potentially including natural language processing (NLP) to identify relevant information.

Data Validation Techniques

Validating extracted data is crucial for ensuring its accuracy and reliability. This process often involves checking for inconsistencies, missing values, and outliers. Data validation techniques can be as simple as checking for specific formats or as complex as using statistical methods to identify anomalies. For instance, checking if dates are within a reasonable range or if numerical values fall within expected bounds are basic validation steps. More advanced validation might involve comparing extracted data against external datasets or rulesets.

Tools and Technologies

Numerous tools and technologies are available for automating data extraction and validation. Python, with its extensive libraries like Beautiful Soup for web scraping and Pandas for data manipulation, is a popular choice. Other languages like R and Java also have powerful libraries for data analysis and processing. Furthermore, cloud-based platforms offer scalable solutions for managing large datasets and complex tasks.

Data Transformation and Cleaning

Extracted data often needs transformation and cleaning before it can be used effectively. This step involves converting data from one format to another, handling missing values, and removing inconsistencies. Properly cleaning the data is essential for accurate analysis and reporting. Techniques such as data imputation and normalization can significantly improve the quality of the extracted data.

Integration with Existing Systems

Once extracted and validated, data needs to be integrated with existing systems or databases. This integration process ensures the data is accessible and usable by other applications or processes. Careful consideration of data formats and structures is crucial for seamless integration. APIs and standardized data formats (like JSON or XML) facilitate the exchange of data between different systems.

Scalability and Performance Considerations

Automating data extraction and validation must be designed with scalability and performance in mind, especially when dealing with large datasets or high-frequency data feeds. Optimizing algorithms and choosing efficient data structures can dramatically improve the speed and efficiency of the process. Cloud computing resources and distributed processing techniques can help manage the increasing demands of processing large volumes of data. Robust error handling and monitoring are also crucial for maintaining performance and ensuring data quality during peak loads.

At the heart of next-generation communication lies a peculiar quantum phenomenon that continues to baffle scientists - the mysterious connection between entangled particles. This invisible thread linking particles across any distance could redefine how we share information. Unlike anything in our classical world, this connection enables instantaneous state correlation that could power networks with speeds and security measures we've only dreamed about until now.

Real-Time Insights and Enhanced Decision-Making

Real-Time Data Integration for Enhanced Insights

Intelligent automation in finance significantly improves the speed and accuracy of data processing. By integrating real-time data feeds from various sources, such as market fluctuations, transaction records, and regulatory updates, financial institutions can gain a comprehensive and up-to-the-minute understanding of the market dynamics. This continuous stream of information allows for more informed and agile decision-making, enabling quicker responses to changing market conditions and opportunities.

This seamless integration of real-time data into automated systems empowers financial professionals to identify trends and patterns that might otherwise go unnoticed. Rapid analysis of market volatility, for example, allows traders to adjust strategies in real-time, minimizing potential losses and maximizing profits. The ability to react instantly to these shifts is critical in today's fast-paced financial markets.

Automated Risk Assessment and Mitigation

Intelligent automation tools provide sophisticated algorithms for assessing and mitigating various financial risks. These systems can analyze vast datasets, identifying potential threats and vulnerabilities in real time, far exceeding the capabilities of human analysts. This proactive approach to risk management allows financial institutions to implement preventative measures, thus reducing operational costs and enhancing overall stability.

Automated risk assessment systems can identify patterns indicative of fraud or unusual transactions. By flagging these anomalies, they help prevent financial losses and maintain regulatory compliance. These systems also improve the efficiency of internal controls, reducing the risk of errors and mishaps.

Improved Operational Efficiency and Reduced Costs

Implementing intelligent automation significantly streamlines financial operations, leading to substantial cost reductions. Automation handles repetitive tasks such as data entry, report generation, and compliance checks, freeing up human resources for more strategic and value-added activities. This efficiency boost translates to reduced operational expenses and increased profitability.

Automating routine tasks not only reduces labor costs but also minimizes human error, a crucial factor in maintaining accuracy and reliability. This minimizes the potential for costly mistakes and ensures adherence to stringent financial regulations. Intelligent automation also enhances the overall efficiency of the entire workflow, leading to faster processing times and improved customer service.

Enhanced Customer Experience and Personalized Services

Intelligent automation facilitates the delivery of personalized financial services, creating a more engaging and efficient customer experience. Automated systems can tailor financial products and services to individual customer needs, offering customized solutions that cater to specific requirements. This personalization fosters stronger customer relationships and drives customer loyalty.

By automating customer service interactions, financial institutions can provide quicker responses to inquiries and resolve issues more efficiently. This enhanced responsiveness translates into a more positive customer experience, ultimately boosting brand reputation and attracting new clients. The ability to provide 24/7 support and personalized services through automated channels significantly enhances the client experience.