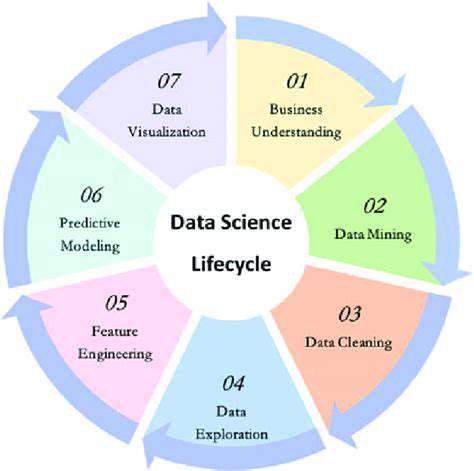

AI-Powered Portfolio Optimization

AI algorithms are revolutionizing investment portfolio optimization by analyzing vast datasets of market trends, economic indicators, and individual investor profiles. This allows for the creation of highly personalized portfolios that are tailored to specific risk tolerances and financial goals. By identifying patterns and correlations that humans might miss, AI can suggest optimal asset allocations, leading to potentially higher returns while mitigating risks.

These sophisticated algorithms can dynamically adjust portfolios in real-time, reacting to market fluctuations and ensuring that investments remain aligned with the investor's objectives. AI-driven portfolio optimization holds immense potential for enhancing investment performance and achieving greater financial success.

Predictive Analytics for Market Trends

AI's ability to analyze massive amounts of data gives it a significant edge in predicting market trends. By identifying patterns in historical data, news articles, social media sentiment, and other relevant sources, AI models can anticipate future market movements with a higher degree of accuracy compared to traditional methods. This advanced predictive capability allows investors to make more informed decisions and potentially capitalize on emerging opportunities.

Enhanced Fraud Detection and Security

AI is playing a crucial role in bolstering security measures in the investment sector. AI-powered systems can detect fraudulent activities, such as market manipulation and insider trading, by identifying unusual patterns and anomalies in transaction data. This proactive approach significantly reduces the risk of financial losses and helps maintain the integrity of the investment markets.

By constantly monitoring and analyzing vast amounts of data in real-time, AI algorithms can detect anomalies and prevent fraudulent activities before they cause substantial harm.

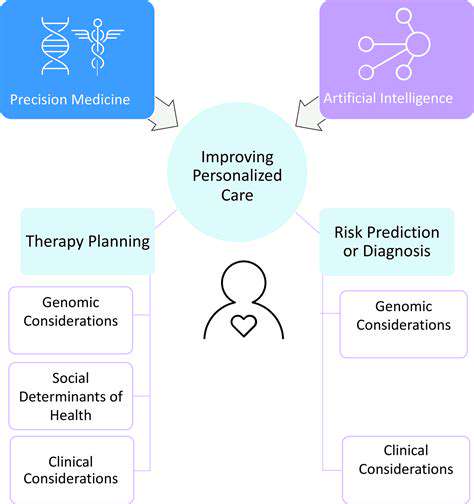

Personalized Financial Advice and Planning

AI-powered chatbots and virtual assistants are transforming the way investors receive financial advice. These tools can provide personalized recommendations, answer investment questions, and offer ongoing support. This accessibility and personalized approach democratizes financial planning, making it more convenient and affordable for a wider range of individuals.

Automated Trading and Algorithmic Strategies

AI is automating trading decisions by developing sophisticated algorithms that execute trades based on predefined rules and market conditions. These algorithms can react to market fluctuations almost instantaneously, potentially achieving higher returns and minimizing human error. This level of automation is crucial for high-frequency trading and other complex market environments.

Risk Management and Mitigation Strategies

AI algorithms can analyze market data and identify potential risks in investment portfolios. By assessing various factors, including economic indicators, market volatility, and individual asset performance, AI can provide insights into potential vulnerabilities. This proactive approach to risk management enables investors to take preemptive measures and mitigate potential losses.

With AI-powered tools, investors can gain a deeper understanding of their risk tolerance and make more informed decisions about their investment strategies.

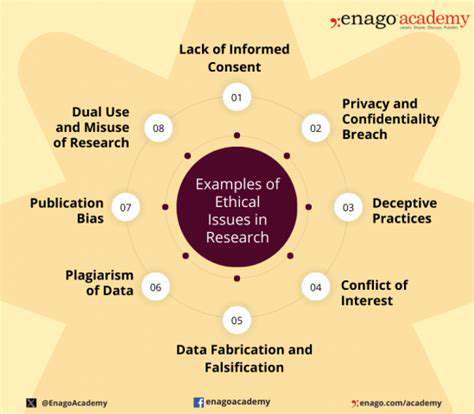

Ethical Considerations and Responsible AI

As AI plays an increasingly important role in investment, it's crucial to address the ethical considerations surrounding its use. This includes concerns about bias in algorithms, potential for misuse, and the need for transparency and accountability. It is essential to ensure that AI systems are developed and deployed responsibly to avoid exacerbating existing inequalities or creating new vulnerabilities in the financial markets. Careful regulation and oversight are vital to ensure that AI benefits all stakeholders.