The Imperative for Digital Transformation in Banking

Embracing the Digital Shift

Today's business environment requires a complete overhaul towards digital transformation. It's not merely about implementing new tools; it's about revolutionizing operations, redesigning workflows, and fundamentally altering how value is generated and distributed. Organizations that resist this change face the risk of being outpaced by competitors and losing relevance in an increasingly digital marketplace. A thorough grasp of both the potential and pitfalls of digital technologies is essential.

This shift calls for cultivating an innovative mindset and being open to continuous change. Digital transformation represents an ongoing evolution rather than a finite goal, requiring constant refinement and adjustment. The key insight is recognizing this as a perpetual cycle of learning, adapting, and enhancing processes.

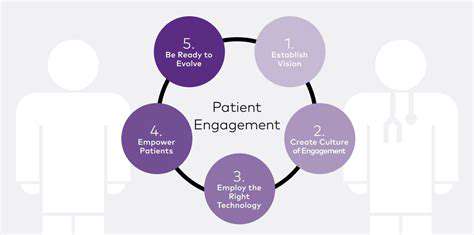

Strategic Alignment and Vision

Effective digital transformation depends on perfect harmony between technological implementation and business goals. Crafting a detailed action plan with specific objectives, deadlines, and success indicators is crucial. Without this strategic foundation, digital projects may diverge from core business aims, resulting in squandered efforts and disappointing outcomes.

A powerful vision statement is vital to inspire staff and nurture an environment of creativity. This vision should clearly depict the intended future, emphasizing how the digital shift will benefit both the organization and its partners. Comprehending the purpose behind the transformation is fundamental for securing commitment and participation.

Data-Driven Decision Making

In our current data-abundant world, harnessing information efficiently is critical for successful digital transformation. Businesses must progress from mere data accumulation to actively employing insights to guide choices and enhance performance across all divisions. This requires establishing comprehensive analytics systems and promoting data proficiency throughout the company.

Insights derived from data offer the essential intelligence to pinpoint optimization opportunities, forecast market shifts, and make well-informed strategic decisions. This approach enables organizations to improve forecasting accuracy, elevate customer interactions, and secure a market advantage.

Adapting to the Changing Workforce

Digital transformation demands a workforce prepared to embrace new technologies and methodologies. This necessitates investment in education and development initiatives that provide staff with necessary digital skills. The strategy should include upgrading existing employee capabilities while actively seeking new talent with relevant digital expertise.

Building a Culture of Collaboration

Effective digital transformation thrives in an environment of teamwork and open communication. Creating spaces where employees across various departments and hierarchical levels can collaborate efficiently is crucial. Establishing transparent communication pathways and encouraging knowledge sharing are fundamental to enabling this cooperation.

Encouraging honest dialogue and transparency is essential for developing trust and creating a unified sense of direction. This fosters a supportive workplace where staff feel confident contributing ideas and assuming responsibility for their part in the digital transformation journey.

Leveraging Data and Analytics for Enhanced Insights

Data Collection Strategies

Meaningful data analysis begins with comprehensive data gathering. This requires precise identification of the necessary data elements to address business queries. Selecting appropriate data channels, whether company records, external interfaces, or market research, is fundamental for obtaining reliable findings. A methodical collection approach guarantees that the data is both dependable and representative, reducing possible distortions and inaccuracies.

Various collection techniques present different advantages and limitations. Surveys can yield valuable subjective insights but may be affected by respondent bias. Direct observation provides real-life perspective but might lack the structured detail of alternative methods. Weighing these trade-offs carefully is imperative.

Data Cleaning and Preparation

Unprocessed data seldom arrives in analysis-ready form. Data purification is an essential phase, encompassing identification and resolution of incomplete entries, anomalies, and discrepancies. This procedure confirms the data's precision and uniformity, decreasing potential mistakes in later examinations. Properly prepared data establishes the foundation for meaningful analysis and prevents erroneous interpretations.

Data conversion represents another vital preparatory step. This may include altering data structures, compiling information into useful overviews, or standardizing measurements. Such modifications frequently enhance analytical model performance substantially.

Analytical Techniques

Numerous analytical approaches exist to derive valuable insights from information. Statistical procedures, including correlation studies and significance testing, can reveal connections and trends within datasets. Advanced computational models can detect intricate relationships and generate projections based on past patterns.

Selecting appropriate analysis methods depends largely on the specific business challenge. Forecasting models might suit sales prediction, while customer classification could benefit from grouping algorithms.

Data Visualization and Communication

Presenting data visually is crucial for effectively conveying findings to decision-makers. Graphical representations and interactive displays can convert complex information into accessible knowledge. Well-designed visual aids facilitate quicker identification of tendencies, correlations, and exceptions, improving data comprehension.

Effective presentation extends beyond raw data display. It involves converting technical findings into practical suggestions and business strategies. Delivering insights in an engaging and understandable format is critical for driving organizational improvements.

Implementing Data-Driven Decisions

The final objective of data utilization is making evidence-based choices. Executing these decisions demands thorough business acumen and the capacity to align data insights with strategic goals. This frequently necessitates cooperation between analytical experts and operational leaders to guarantee relevance and applicability.

Translating data intelligence into concrete enhancements requires a definitive implementation strategy. This includes establishing precise success indicators and creating mechanisms for tracking advancement.

Securing the Digital Future of Banking

Protecting Sensitive Data in the Digital Age

The digital revolution in banking has created remarkable possibilities for advancement and productivity, but it has simultaneously exposed new security gaps. Safeguarding confidential client information is critical. Powerful encryption standards, layered verification processes, and routine security assessments are necessary to prevent intrusions and preserve customer confidence. Additionally, financial institutions need to allocate resources to sophisticated threat identification systems that monitor and counteract cyber threats instantly, protecting financial operations and personal data continuously.

Establishing comprehensive data management protocols is imperative. These guidelines must define explicit methods for information retention, permission management, and data elimination. Regular cybersecurity education for personnel is crucial to cultivate a security-conscious workplace. Staff should recognize fraudulent attempts, manipulation strategies, and other possible hazards to block illegal access to protected data. By emphasizing data protection initiatives, banks can strengthen client trust and ensure financial security.

Maintaining an edge against developing cyber risks is an endless endeavor. Financial organizations must continually modify their protective measures to address emerging vulnerabilities. This demands persistent surveillance, evaluation, and adjustment of security procedures to match the dynamic threat environment. Regular assessment and enhancement of protective systems, including network barriers, unauthorized access detection, and malware protection, is vital for sustaining strong defenses against digital criminals.

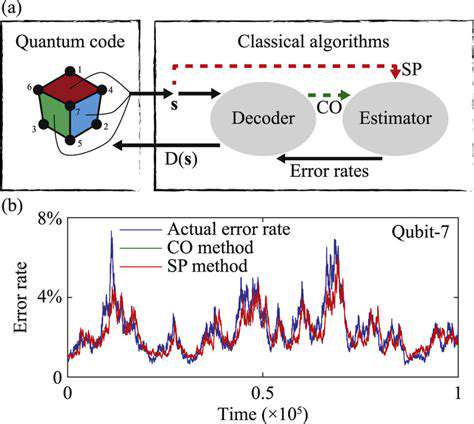

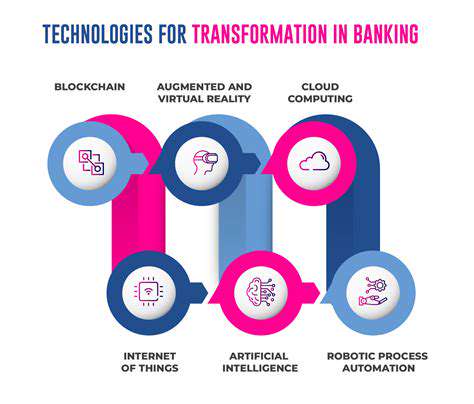

Embracing Advanced Technologies for Enhanced Security

Incorporating cutting-edge solutions like artificial intelligence (AI) and machine learning (ML) is critical for strengthening bank security frameworks. AI-driven platforms can process enormous data volumes to detect trends and irregularities signaling potential breaches. This forward-looking method enables early threat identification and response, limiting possible harm. By automating security functions, banks can alleviate pressure on security personnel, allowing them to concentrate on higher-level strategic priorities.

Adopting distributed ledger technology can improve the security and clarity of financial dealings. Blockchain's decentralized structure makes data manipulation exceptionally challenging, thereby reinforcing the integrity of financial documentation. This innovation can support secure identity confirmation and digital asset administration, further strengthening banking security measures.

Implementing biometric authentication, including fingerprint or facial scanning, for account access can dramatically improve online banking security. This presents a more secure replacement for conventional passwords, complicating unauthorized account access attempts. Through integration of these sophisticated protective measures, banks can establish a more secure and reliable digital banking ecosystem for their clients.

Implementing comprehensive cloud protection strategies is equally important in today's digital landscape. Financial institutions must emphasize the security of their cloud platforms and stored information to defend sensitive data. This entails enforcing strict access limitations, data encryption, and regular security evaluations of cloud-hosted services.